New flood insurance scheme for properties at risk

Over recent years, the UK has been affected severely by a number of winter storms. Which is resulting in coastal damage and widespread, persistent flooding. December 2015 was the warmest and wettest for over 100 years. That resulted in widespread flooding across Cumbria and North-east Scotland, affecting over 16,000 homes in England alone. Figures released from the Association of British Insurers (ABI) suggested that the economic losses from flood and storm damage over this period exceeded those from 2013-14. This was during the wettest winter on record, with members paying out over £1.3 billion for claims.

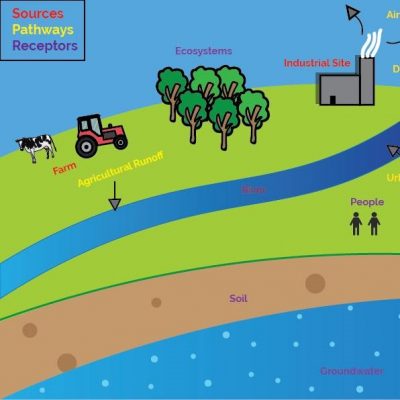

Across the UK, more than 5 million properties and a significant portion of the Nation’s key infrastructure are understood to be at risk from flooding (Thorne, 2014). The increasing number of large scale floods have highlighted the impact of flooding on those who struggle to find affordable home insurance. Flood insurance has been widely available to households at high risk of flooding since 2000. This is due to a series of voluntary agreements between the Government and members of the ABI. However, these agreements did not cover the affordability of the home insurance provided.

In order to tackle this problem, insurers and the Government have worked together to introduce a ‘flood re-insurance’ scheme. Known as Flood Re, to help support households at highest flood risk.

Features

Flood Re launches this month (April 2016) or a period of 25 years and according to the Flood Re website is designed to:

- enable flood cover to be affordable for those households at highest risk of flooding;

- increase availability and choice of insurers for customers;

- allow time for the Government, local authorities, insurers and communities to become better prepared for flooding; and

- create a ‘level playing field’ for new entrants and existing insurers in the UK home insurance market.

However, a recent paper, published by the London School of Economics, has raised concerns that climate change could result in the Flood Re scheme failing to reduce flood risk. The paper finds that the number of London Households eligible for the scheme could increase by 75 % during its 25 year lifespan. Climate change coupled with a high housing demand are likely to lead to a significant increase in the number of properties affected by surface water flooding. The report also suggests that an opportunity to incentivise greater resilience to flooding has been missed.

Overall, increased investment in SuDS (Sustainable Drainage Systems) for existing and new properties and Property Level Protection Measures (PLPM) is required to increase our resilience to climate change and flooding in the future.

Here at RMA we provide a variety of Flood Risk services: Find out More